Around the Block | 3

Stay informed with Bitcoin news, technical analysis, and fundamentals—all in one place.

Welcome to the third edition of Around the Block, your no-fluff Bitcoin newsletter.

If you’ve been following along since the beginning—thank you. And if this is your first time here, welcome. Whether you're a battle-tested Bitcoiner or just starting to understand what makes this protocol tick, there’s something here for you. We’re here for signal, not noise—deep dives into technicals, fundamentals, and the macro picture that actually matters.

I still keep my lens focused on the daily and weekly timeframes, with an eye on the monthly to stay grounded in the big picture. The goal? Context, conviction, and clarity in a market that often thrives on confusion.

As always, for more frequent insights and Bitcoin banter, you can find me on X @WillSanchezJr. If you get value from this, share it with a friend. It’s free—for now.

None of this is financial advice.

And as always: Don’t trust, verify.

Let’s get into it. 🚀

Technicals

Monthly

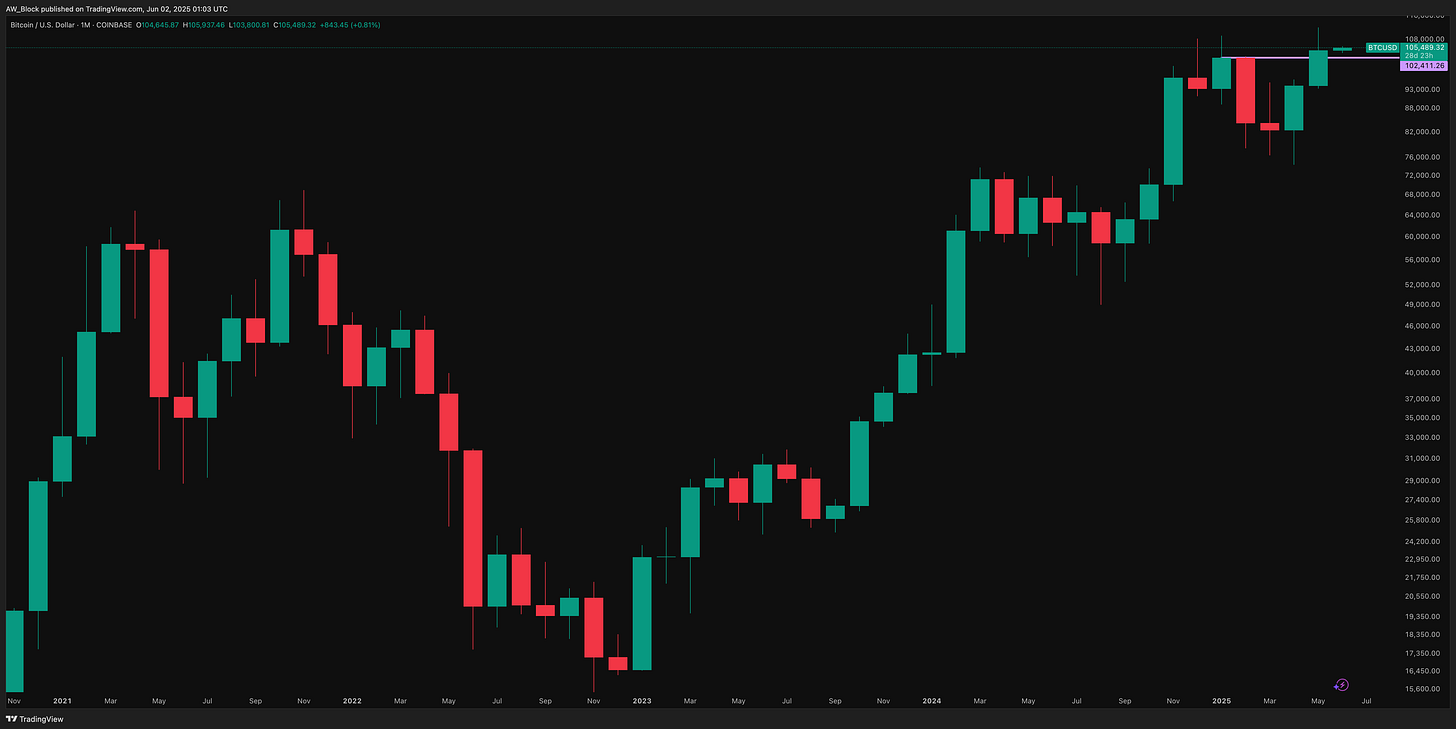

First things first — we just had the highest monthly candle close in Bitcoin history.

Congratulations to the bulls and HODLers! There’s still work ahead, but in my humble opinion, the party is far from over. Stay sharp, stay focused — we’re not done yet.

In my last newsletter, I highlighted the historical relationship between price and the 50WMA. Lately, I've seen a bit more bearish chatter on the timeline, so I thought now would be a good time to shift focus to the 8EMA (yellow line). Over the past three months, price has retested the 8EMA around ≈$81,000 USD. Historically, bear market price action tends to emerge when monthly candles start closing below the 8EMA. As of now, we’re not there yet. It’s not a standalone signal, but when used alongside other technical tools, it can help clarify where we are in the broader cycle.

Weekly

Bulls went above and beyond what was outlined as needed in last month’s newsletter. Still, as bullish as I am, I can’t just feed you tunnel-vision optimism. One thing that stands out—and not in a great way—is how we took out the previous all-time highs on the weekly chart, only to close with a bearish engulfing candle right at the top. I’m not calling for a drop to $50K, but this could signal a short-term cool-off. Maybe it’s just “Sell in May and walk away” PTSD, but failing to close above the ATHs with conviction deserves some caution.

IF (and that’s a big if) this was the top, then from a long-term, patient perspective, anywhere in the green box looks like a solid buy zone. Some folks will be screaming that the sky is falling—but in reality, it would just be another macro buying opportunity in Bitcoin’s larger cycle. Like I always say, plebs lose their minds over a 50% off TV, but not over the greatest asset protocol of my lifetime. And don’t forget my other mantra: PAYtience PAYS.

But Bitcoin won’t just stroll into that green box without putting in some work first. So let’s wait for that proof of work and be ready if that scenario plays out—just like we prepared during the bear markets for the all-time highs we’re experiencing now, and the ones still to come.

As stated in previous newsletters my eyes were always on the ≈$90,000-$92,000 range to tell us where we are. I stressed when we were at $75,000 with confidence that the bull party won’t continue until we reclaim that ≈$90,000-$92,000 range.

In last month’s newsletter, I wrote: “For a stronger outlook, price action needs to reclaim the bottom of the previous upper range, around $90K–$92K. On the daily timeframe, a key hurdle is also reclaiming the 200DMA.” We’ve done exactly that—reclaimed both the prior range and the 200DMA. As long as these levels hold as support, I’m feeling great. Losing them, however, would likely signal that the bears are starting to gain momentum.

Overall, the bottom of the upper range (light blue box) still holds as a critical level, though the context has shifted slightly since we’ve made new all-time highs after breaking and reclaiming it. If we break this range again, the technicals suggest a potential retest of the prior range between roughly $53,000 and $74,000, as outlined in the weekly Fibonacci analysis above.

Daily

Just like we highlighted the 50WMA’s relationship with price action in the last newsletter—and the 8EMA on the monthly timeframe—we can zoom into the daily chart and spot a similar dynamic. Price had been riding the daily 8EMA all the way up as we pushed into new all-time highs. But recently, we’ve seen multiple closes below it, signaling a potential cooldown.

If we get rejected at this weekly resistance level, I’d expect support to show up around the $96,000–$98,000 range on the daily chart.

While I’m not the biggest fan of moving average crosses since they tend to be lagging indicators, it’s worth noting we just got a golden cross on the daily—where the 50MA crossed above the 200MA—which is typically seen as a bullish sign.

Above is a screenshot of all the golden crosses we’ve seen on the daily timeframe since this cycle’s bottom. We’ve just had our fourth one—fake out or moon mission? You tell me.

Fundamentals

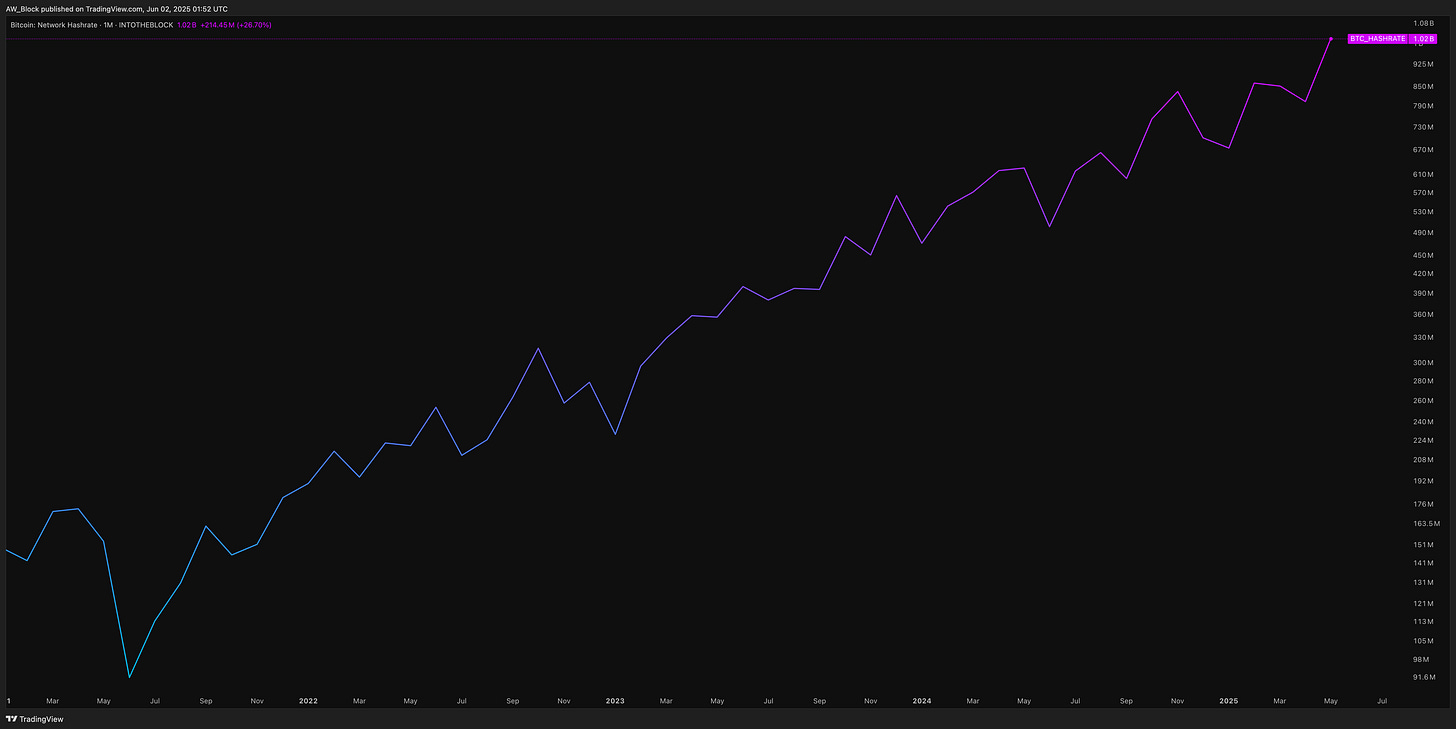

Hashrate

The chart shows a strong uptrend in Bitcoin’s network hash rate, now sitting at 1.02 ZH/s, marking a +26.70% increase month-over-month. This marks the highest recorded hash rate in Bitcoin’s history and reflects growing miner confidence and increased investment in infrastructure despite recent volatility.

Notably, the hash rate has continued climbing with only minor pullbacks, confirming a persistent bullish trend in network security and decentralization. The consistent rise supports the thesis that the network is healthier and more secure than ever heading into the second half of 2025.

AVG Mining Cost

As of May 30, 2025, the average cost to mine one Bitcoin is roughly $91,000 USD — a slight increase of ≈$1,000 from the last report.

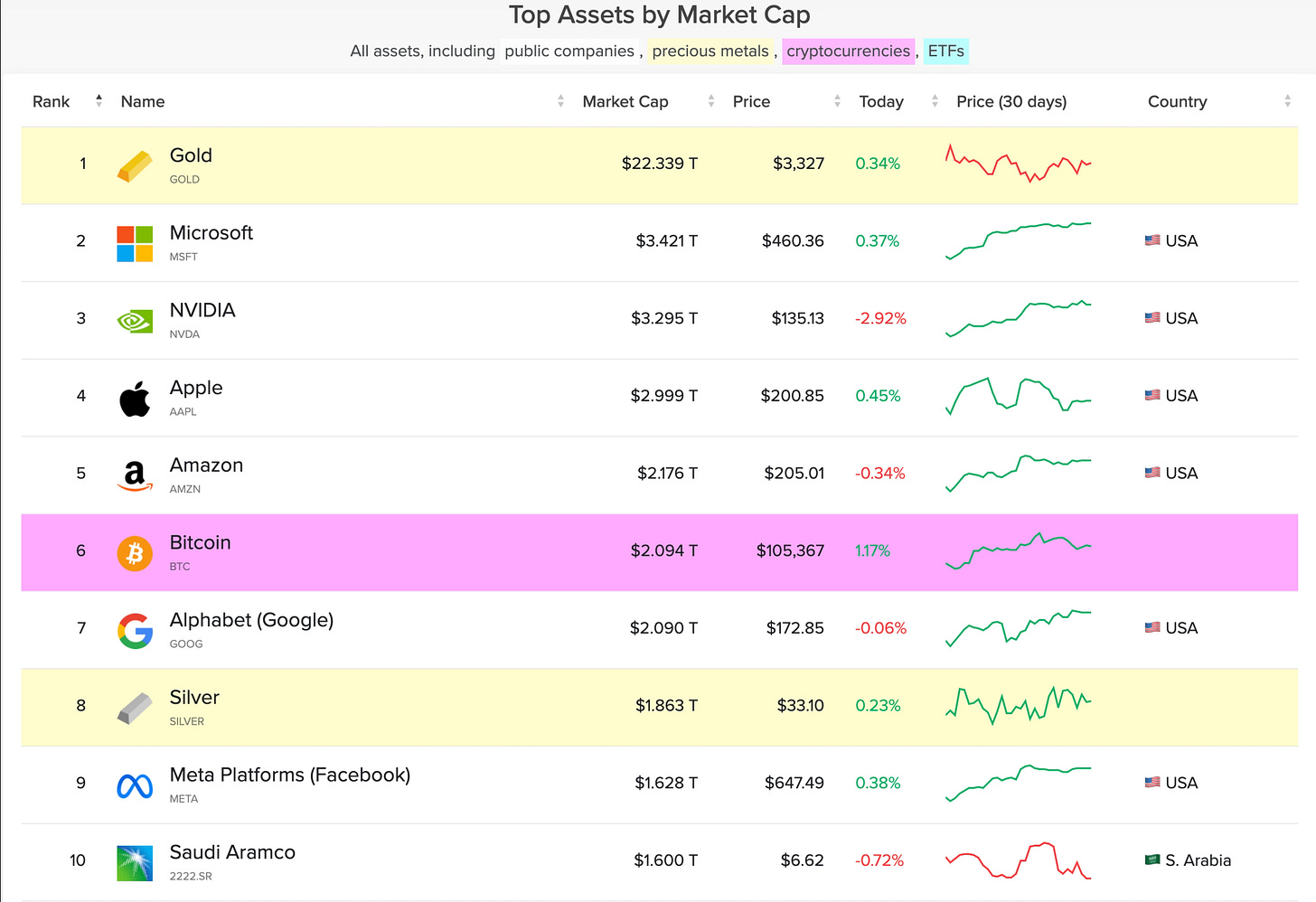

Market Cap

Bitcoin’s market cap is back above $2 trillion, currently sitting at $2.094 trillion — an 11.74% increase over the past month. Since launching this newsletter, it’s been nothing but green candles on the market cap front. Tis the season!

Bitcoin News

Highlights from the month of May

New Hampshire Becomes First State to Pass Strategic Bitcoin Reserve Bill Into Law

Arizona Becomes Second State to Establish Strategic Bitcoin Reserve

Jack Maller’s Strike Launches Bitcoin-Backed Loans for Eligible U.S. Customers

Steak ‘n Shake Will Accept Bitcoin Payments in All U.S. Locations Starting Next Week

Texas Legislature Passes Bitcoin Reserve Bill

GameStop Buys $513 Million Worth of Bitcoin

If you have any suggestions, feel free to reach out to me on X. I’m always looking to improve and add value in ways others might enjoy—just keep it Bitcoin only.

Live free and stack sats,

Will

”Bitcoin will change us more than we will change it” - Marty Bent