Around the Block | 5

Stay informed with Bitcoin news, technical analysis, and fundamentals—all in one place.

Welcome to the fifth edition of Around the Block, your no-fluff Bitcoin newsletter.

Another month in the books, and Bitcoin continues to do what it does best—shake out the weak hands and reward those with conviction. Whether you’re watching key levels on the daily or just checking the monthly for long-term structure, this issue is built to keep you grounded in the signal, not the noise.

We’ll cover the charts, the hash rate, macro market context, and what I’m watching next. As always, no altcoin hype, no fluff—just the meat and potatoes of Bitcoin.

None of this is financial advice.

Don’t trust, verify.

Let’s dive in.

Note: I usually include a color key for my charts. I’ve updated some colors recently and haven’t gotten around to rebuilding the full legend yet. That said, all EMA and MA colors remain unchanged. A few new tools and S/R zones have been added, but everything should still be easy to follow since each chart is tied directly to its corresponding timeframe analysis.

The Technicals

Monthly

Bitcoin is doing its thing with another monthly close that marks the highest in its history, yet everyone on the X timeline seems bearish—why? We haven’t even retested the 8EMA on the monthly chart. Bitcoin has now closed three consecutive monthly candles above the prior all-time high resistance zone. Price remains above the key breakout region between $102,000 and $110,000, which it's now testing from above.

June gave us a strong bullish expansion candle, while July followed with a small-bodied continuation candle that confirmed support above the breakout. The 8EMA, 34EMA, and 50MA are all bullishly stacked, with the 8EMA (yellow) currently acting as dynamic monthly support. Price remains well above all key moving averages, keeping the macro trend fully intact.

Volume has been declining for four consecutive months. While this isn’t a bearish divergence by itself, it does suggest a lack of strong conviction. When you pair lower volume with tight consolidation, it often signals a pause before the next leg up.

Weekly

Bitcoin is pulling back after repeated rejections near $122,000, forming what could be a local top. Price is currently resting cleanly on the $114K–$116K breakout support zone, with secondary support below at $104K–$109K. The structure remains intact, with no signs of breakdown. Recent candles show consolidation, and price continues to ride the 8EMA, a typical feature of strong bullish trends.

The moving averages are in full bullish alignment, and momentum remains upward with no weakness in slope or crossovers. Volume has cooled slightly, but there are no signs of distribution or exhaustion. A weekly close above $122K could trigger the next leg higher. Overall, the trend remains healthy.

Daily

Bitcoin is currently trading below the key $115,800 resistance level after a sharp rejection from the ~$120,000 range highs. Price found support near the daily S/R zone around $112,000, which sparked a relief bounce—but that bounce is now stalling at prior support, which has flipped into resistance. This setup hints at a possible bearish S/R flip.

Key levels to watch:

~$120K: Range high and local resistance

~$115.8K: Former support, now resistance

~$112K: Current bounce support zone

~$107K–$108K: Strong daily demand below

Price action remains range-bound and is now testing the underside of broken support. So far, no strong bullish reversal patterns have emerged. The current candle is printing just below resistance with a small real body, showing buyer hesitation and the potential for rejection.

Structurally, Bitcoin remains in a corrective phase with lower highs and lower closes developing over recent sessions. The initial bounce from ~$112K was backed by heavy volume, showing short-term interest, but the current push higher is occurring on declining volume, which weakens its credibility.

The EMAs and MAs are showing early signs of shifting:

8 EMA (yellow) is turning down and acting as intraday resistance

34 EMA (green) is flattening, pointing to a loss of upward momentum

50 MA (orange) is still rising and sits not far below price, offering dynamic support near $112,000

Overall, bulls need to reclaim $115.8K with strength to regain control. Otherwise, the risk of further downside remains on the table.

The Fundamentals

Hashrate

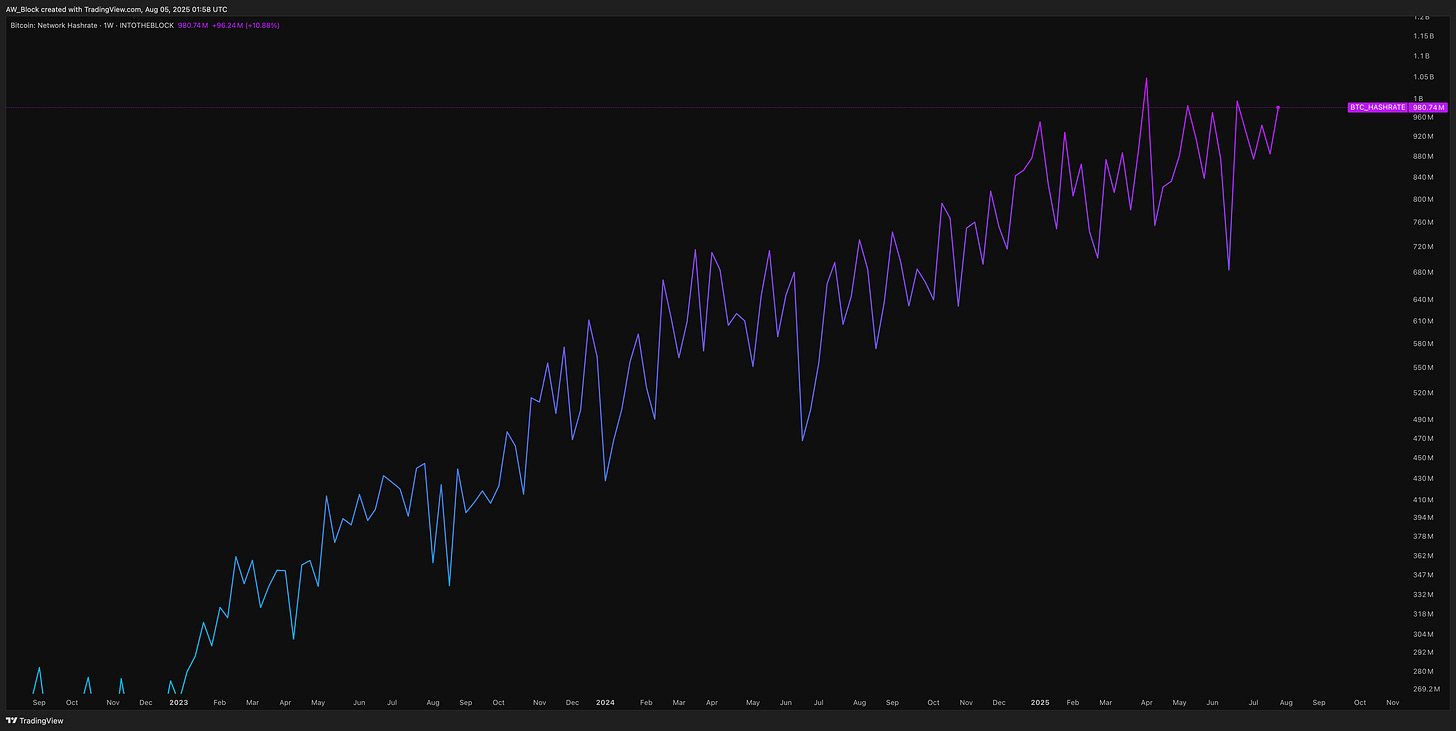

Bitcoin’s hash rate continues to trend higher, now sitting at 980.74M TH/s — a 10.88% increase from last month. This rise reflects renewed miner confidence and sustained investment in infrastructure despite recent price consolidation. The chart shows consistent higher lows and a strong recovery from the June dip, suggesting that network security and decentralization remain on solid footing.

Hash rate strength like this, especially while price consolidates, reinforces the long-term health of the protocol. There are no signs of miner capitulation. If anything, it looks like they’re doubling down.

AVG Mining Cost

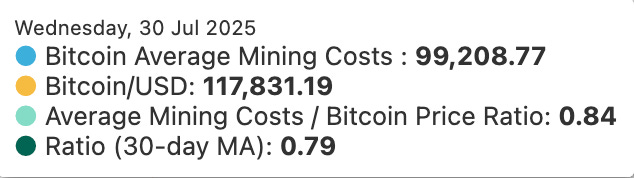

As of July 30, 2025, the average cost to mine one Bitcoin is approximately $99,208.77, marking a sharp increase of over $11,000 from last month’s estimate. With Bitcoin currently trading around $117,831, the mining cost-to-price ratio sits at 0.84, while the 30-day moving average of the ratio is slightly lower at 0.79.

This uptick in mining costs reflects rising hash rate competition and possibly higher energy expenditures across the network. While margins remain profitable, they’re tightening. Continued increases in operational costs may start to put pressure on less efficient miners if price fails to expand further.

Market Cap

As of August 4, 2025, Bitcoin’s market cap is sitting at $2.283 trillion, up 6.2% from last month’s $2.149 trillion figure. It now ranks #6 among the world’s largest assets, narrowly behind Alphabet and above Amazon, Silver, Meta, and Saudi Aramco.

Bitcoin continues to hold its ground above the $2 trillion threshold, signaling sustained strength and institutional interest despite short-term market chop. Holding this level while climbing the global leaderboard isn’t just optics—it’s fundamental validation in real time.

Bitcoin News

Trump Signs GENIUS Act Into Law, Will Make America “The Crypto Capital of the World”

PayPal Opens Bitcoin And Crypto Payments to US Merchants

Crypto ETFs See Recor $12.8B Inflows In July as Market Rallies to New Highs

Crypto market absorbs $9bn bitcoin sale with ‘barely a blip’

Treasury Secretary Bessent Remarks at the Launch of the White House Digital Assets Report

If you have any suggestions, feel free to reach out to me on X. I’m always looking to improve and add value in ways others might enjoy—just keep it Bitcoin only.

Live free and stack sats,

Will

“Building a portfolio around shitcoins is just a shitfolio.” - Saifedean Ammous