Around the Block | 6

Stay informed with Bitcoin news, technical analysis, and fundamentals—all in one place.

We’ve officially closed out another monthly candle, and Bitcoin continues to hold its ground. It’s grinding through resistance, testing conviction, and reminding us why zooming out still matters. Whether you’re here for the TA, the macro structure, or just trying to keep your signal-to-noise ratio clean, this issue has you covered.

As always, we’ll break down the key levels, moving averages, volume structure, and broader market context. No altcoin distractions. No hype. Just Bitcoin.

None of this is financial advice.

Don’t trust, verify.

Let’s dive in.

Technicals

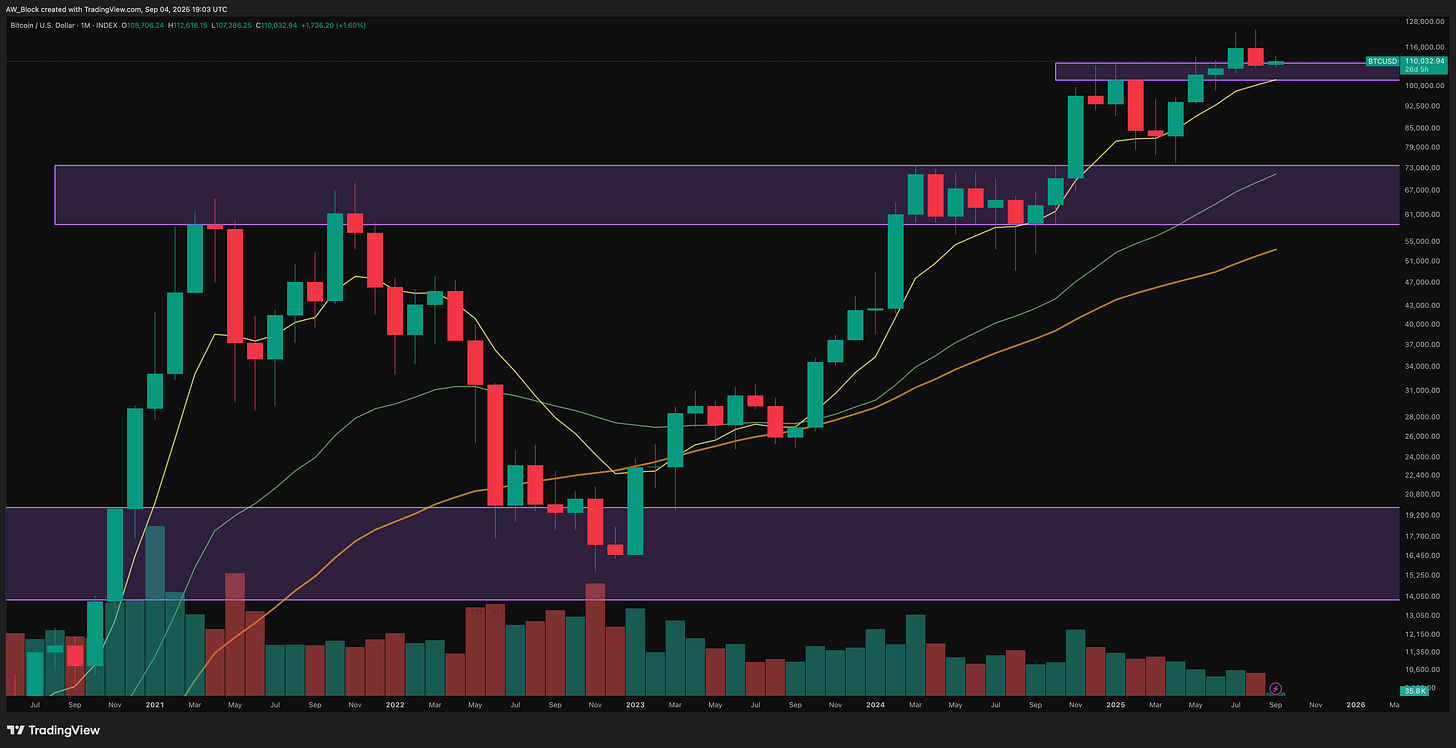

Monthly

Bitcoin continues to consolidate just above the $102,000 to $110,000 breakout zone, which acted as key resistance earlier in the year and is now being retested as support. The last two monthly candles have printed smaller bodies near the highs, suggesting a pause following strong expansion. Structurally, the long-term trend remains intact with a clear pattern of higher highs and higher lows. This still looks like healthy consolidation within an uptrend, not the start of a breakdown.

Key monthly support levels include the $102K–$110K breakout zone and the broader $58K–$73K area, which aligns with the former all-time high cluster and long-term demand. July and August both produced strong breakout candles above $110,000, and the recent slowing momentum fits well with Schabacker’s concept of “congestion at resistance”—a common setup that often resolves higher if support continues to hold.

From a moving average standpoint, the 8 EMA (yellow) is rising steeply and providing dynamic support just beneath price. The 34 EMA (green) is also trending upward, reinforcing medium-term momentum, while the 50 MA (orange) sits well below current levels, offering deep structural support as it continues to rise.

Volume has steadily declined throughout the past three months of consolidation. This kind of lower volume is typical of trend pauses and does not signal distribution. Without any major spikes in selling pressure, the broader environment continues to lean toward bullish continuation, provided key support levels are respected.

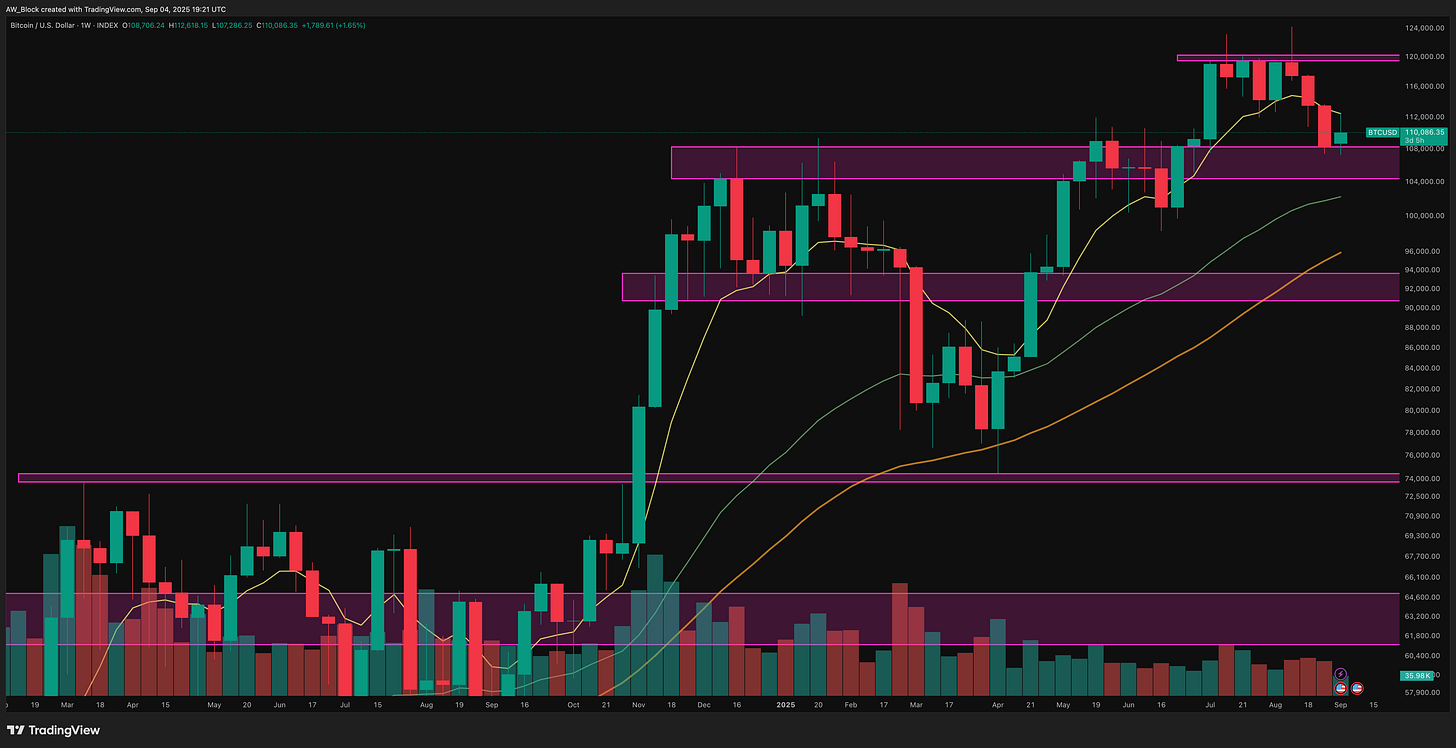

Weekly

Bitcoin has pulled back from the recent ~$124,000 high and is now sitting right on top of the $104,000 to $108,000 weekly support zone. This area has been structurally important since 2024 and is shaping up to be the line in the sand. Holding this zone keeps the breakout structure intact, but losing it would open the door to a deeper retracement. The past three weekly candles have all closed red, signaling short-term corrective pressure following Bitcoin’s attempt at price discovery. Still, the move appears controlled and not indicative of a breakdown just yet.

Recent candles have shown upper wicks near $120,000, confirming that sellers have been active at that level. This week’s candle is printing with a longer lower wick, suggesting some defense by buyers around $110,000. If this closes as a hammer or similar reversal pattern, it could mark a short-term base at support. A close below $104,000, however, would confirm a structural breakdown and likely send price toward the next major demand zone between $90,000 and $94,000.

From a trend perspective, the 8 EMA (yellow) now sits just above price and is acting as short-term resistance. The 34 EMA (green) is still rising and sits near $102,000, which would be the next level to watch for a bounce if support breaks. The 50 MA (orange) is further below, near $96,000, aligning with broader structural demand.

Volume has picked up slightly during the pullback, but there has been no major distribution spike or sign of capitulation. This still looks like a controlled correction rather than panic-driven selling. As long as Bitcoin holds above the $104,000 to $108,000 zone, the broader bullish structure remains valid.

Daily

Bitcoin continues to struggle following the rejection near $124,000. The short-term structure remains bearish, with recent daily candles forming lower highs and lower lows, keeping the local downtrend intact. Price is effectively range-bound between $109,000 support and $112,000 resistance, and there has yet to be a strong catalyst to break either side.

Key daily levels to watch include the ≈$124,000 rejection zone at the range high, ≈$116,000 midrange resistance, and the ≈$112,000 zone, which continues to act as short-term rejection. Immediate support lies around $108,000, while deeper demand sits between $101,000 and $102,000—an area that also aligns with the 200-day moving average.

Recent candlesticks have printed long upper wicks, showing sellers are actively defending the $112,000 area. There is no bullish reversal pattern yet, meaning buyers are defending the level, but bears still control the momentum.

Moving averages are reflecting this loss of strength. The 8 EMA (yellow) is acting as near-term resistance, with price rejecting cleanly from it. The 34 EMA (green) has flattened, signaling a loss of momentum, while the 50 MA (orange) is now overhead, reinforcing resistance. The 200 MA (blue) continues to trend upward around $101,000, offering strong structural support should $109,000 break.

Volume has picked up during recent drops, though there has been no blow-off selling or panic. The current structure looks more like controlled distribution rather than capitulation. As it stands, the daily chart shows short-term weakness. Price remains capped below $112,000 and is holding just above $109,000 support. A break below $109,000 on strong volume would likely send price toward the $101,000 to $102,000 range. On the flip side, reclaiming $112,000 would be the first sign of strength and could shift momentum back toward $115,000 or higher. Until then, the structure favors the bears, and I’ll be watching closely for signs of a change in trend.

Fundamentals

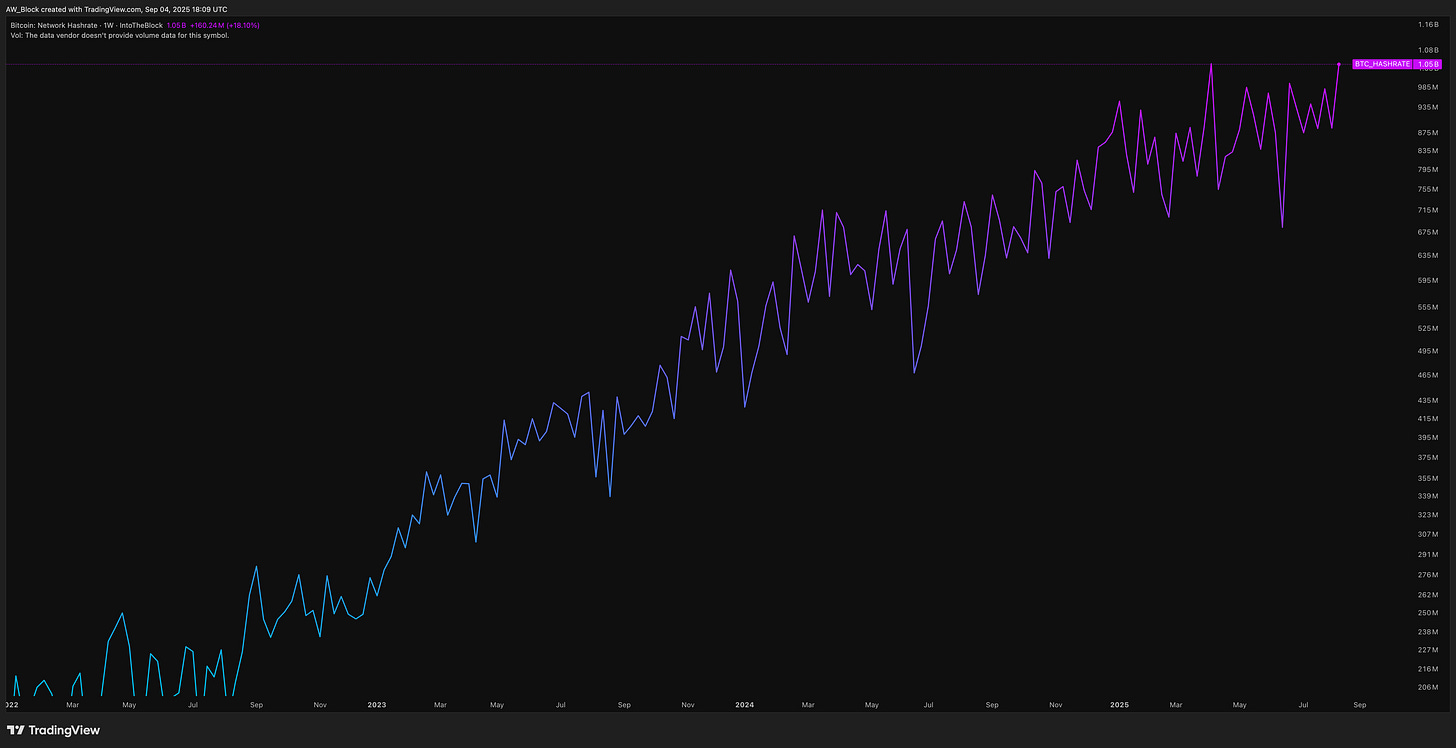

Hashrate

Bitcoin’s hash rate has reached a new all-time high of 1.058 billion TH/s, rising 8.10 percent from last month. The network continues its strong upward trend, building on last month’s breakout above the 980 million mark. Higher lows and steady growth remain the theme, reflecting growing miner confidence and ongoing global investment in mining infrastructure.

This kind of hash rate expansion during a period of price consolidation is a powerful signal. It shows the protocol is becoming more secure and that miners are leaning in, not backing off. No signs of capitulation. Miners are scaling with conviction.

AVG Mining Cost

As of September 2, 2025, the average cost to mine one Bitcoin is approximately $95,368, down modestly from last month’s $99,208 estimate. With Bitcoin currently trading around $110,000, the mining cost-to-price ratio stands at 0.86, while the 30-day moving average ratio sits slightly lower at 0.83.

This slight decline in mining cost may reflect short-term shifts in network efficiency or regional energy adjustments, even as hash rate climbs. Profit margins remain healthy, but the rising ratio signals that miners are operating closer to breakeven than in prior months. If price weakens or energy input costs rise again, pressure may return for higher-cost operators.

Market Cap

As of September 4, 2025, Bitcoin’s market cap sits at $2.188 trillion, placing it at #8 among the world’s largest assets. It now ranks below Silver and Amazon, having slipped two spots from last month’s position at #6.

The drop reflects both a broader pullback in Bitcoin’s price and strong relative performance from other mega-cap assets. Still, Bitcoin continues to hold above the $2 trillion threshold, a level that represents more than just psychological support. This kind of resilience signals that institutional interest and long-term conviction remain intact, even in the face of near-term volatility.

Holding ground here keeps Bitcoin firmly in the conversation with the world’s most valuable assets.

Bitcoin News

Highlights from the month of August

Historic First: U.S. Government Posts GDP Data on Bitcoin Blockchain

If you have any suggestions, feel free to reach out to me on X. I’m always looking to improve and add value in ways others might enjoy—just keep it Bitcoin only.

Live free and stack sats,

Will

”Money, historically, has been a creature of the market, not a creature of the State. If anything, that is the perversion.” - Murad Mahmudov