Around the Block | 1

Stay informed with Bitcoin news, technical analysis, and fundamentals—all in one place.

Welcome to the First Edition of Around the Block

I’m excited to kick off this journey and build a space for constructive conversations, learning, and maybe even some lasting friendships along the way.

Whether you're a seasoned Bitcoiner—a true Bitcoin Maxi—or just dipping your toes into the waters of this revolutionary asset, this newsletter is for you. If you trade using technicals or fundamentals, you’ll find value here. Just don’t expect any shitcoin charts—not here, not ever.

For now, this newsletter will be a monthly deep dive—focused on the meat and potatoes of Bitcoin, not the fluff. There’s a lot of nothing-burger news and noisy charts out there, but I believe it’s best to zoom out, reflect, and focus on the bigger picture.

When it comes to trading, my go-to timeframes are the daily and weekly, with the 4H close behind. While writing this, I also keep an eye on the monthly to ensure we stay grounded in the macro trend.

For daily insights, discussions, and weekly updates, you can find me on X @WillSanchezJr. If you like what you read, share it with a friend and subscribe. For now, this newsletter is free for all to enjoy.

None of what I say is financial advice.

“Don’t trust, verify”.

With that being said, let’s dive in. 🚀

The Technicals

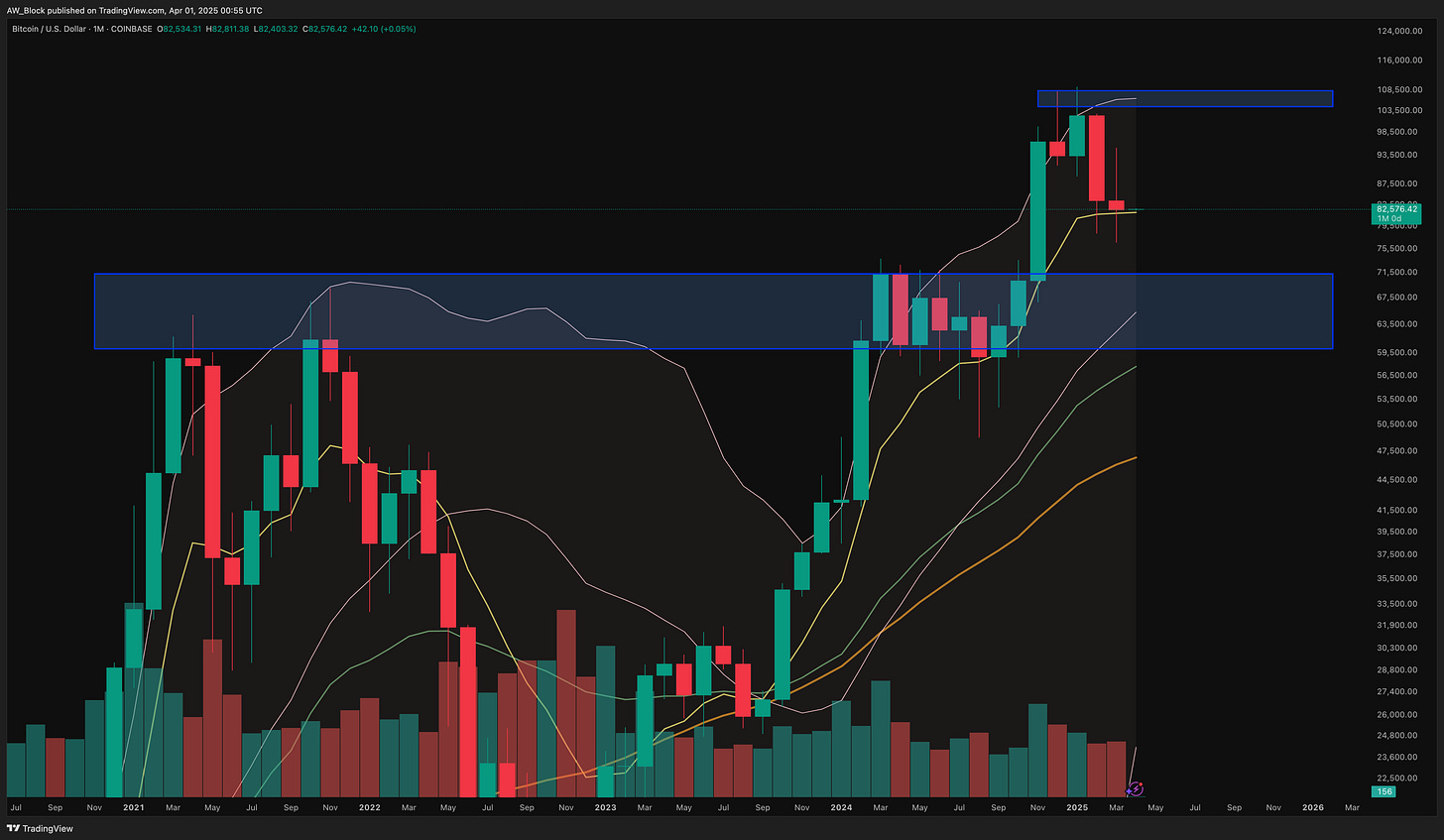

Monthly

When analyzing the monthly chart (Image 1), I see a break out of a range and a possible retest of that range. I remain neutral—neither strongly bearish nor bullish. My focus is on the yellow line, the monthly 8 EMA, which I expect to either hold as support or break down, leading to a retest of that previous range.

Weekly

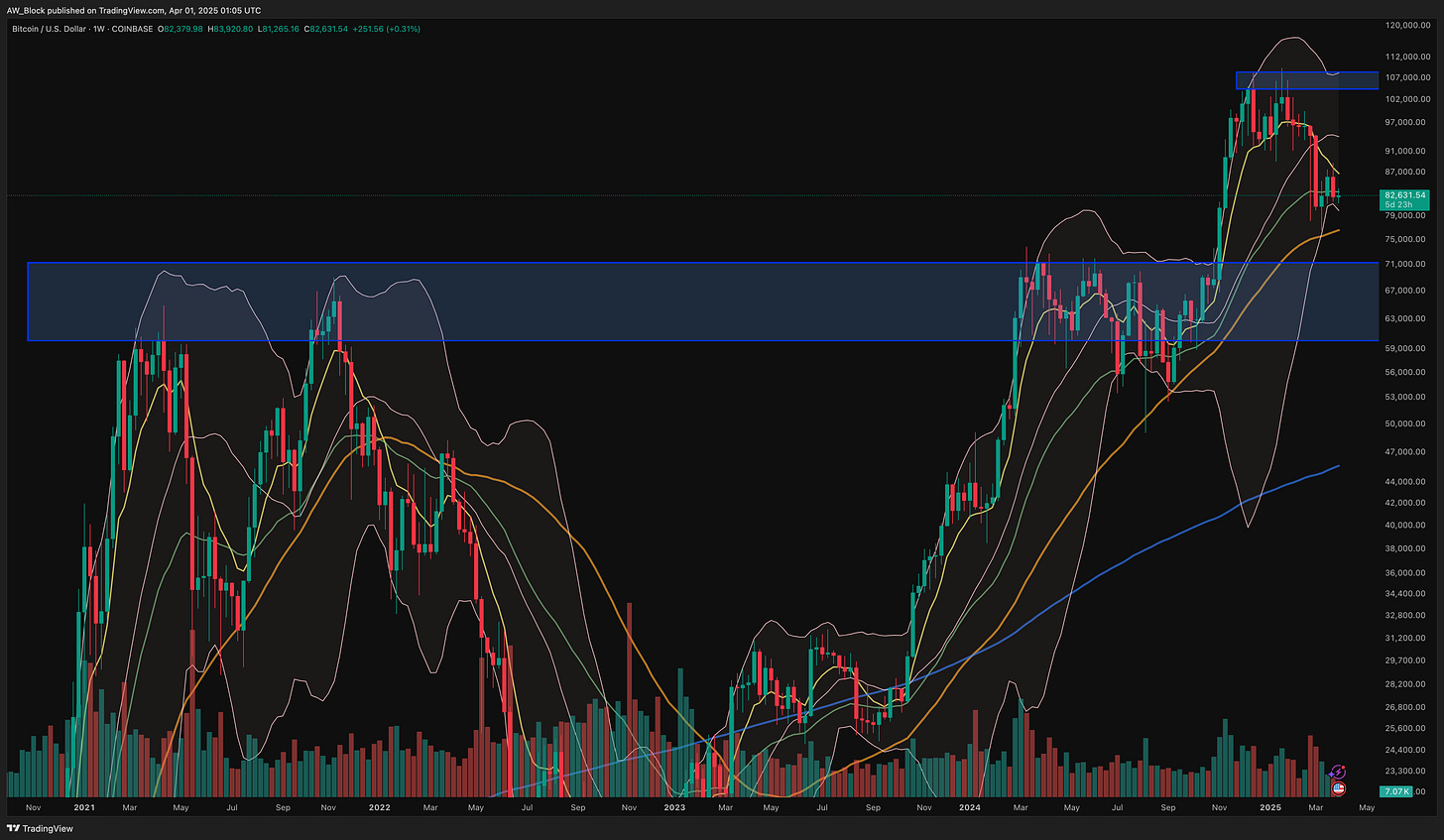

Before diving into this weekly breakdown, let me be clear—I firmly believe this bull run is NOT over. But for the sake of discussion, let’s assume it is. What now?

In my article, “The Macro Analysis of Bitcoin and How You Can Financially Take Advantage” I outline a scenario that would still apply if we were entering a bear market. The answer? Chill. Wait. PAYtience.

People rush to buy TVs at 50% off but hesitate when Bitcoin—one of the best-performing assets of the past decade—goes on sale. Anything within the 50%-78.6% Fibonacci retracement levels (Image 3) is a prime accumulation zone for those willing to wait. Beyond that, I expect strong buying pressure to kick in quickly.

These are the best levels to DCA in, and if price approaches that 78.6% retracement, I’ll be licking my chops to scoop up more Satoshis. Also, keep an eye on the 200WMA (Image 4), which is lurking in that 78.6% region and should act as a major support level.

Patience pays in Bitcoin. Always has. Always will.

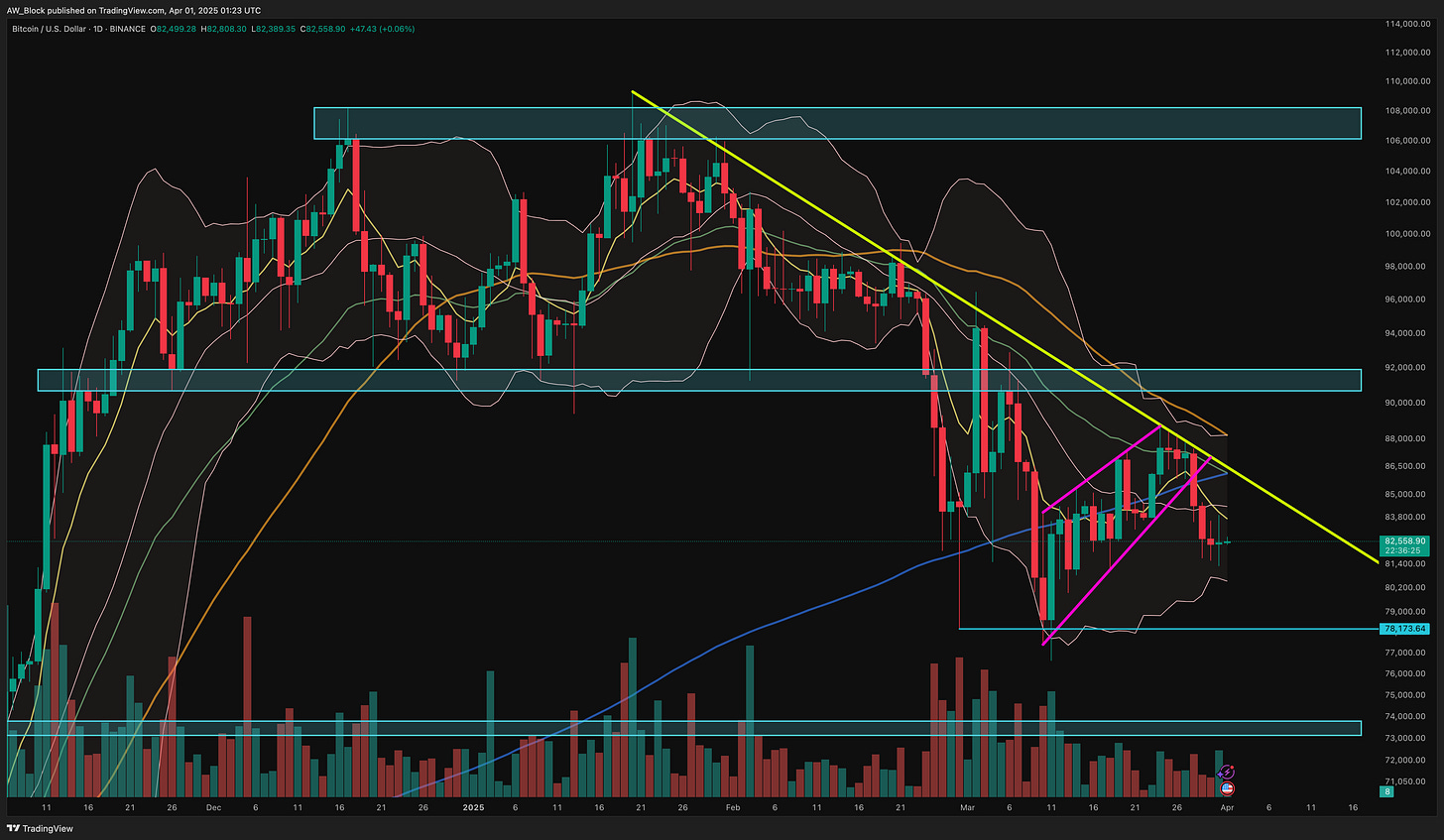

Daily

As for the daily time frame I’m not feeling overly bullish just yet. For a stronger outlook, price action needs to reclaim the bottom of the previous upper range, around $90K–$92K. On the daily timeframe, a key hurdle is also reclaiming the 200DMA as well.

Until then, I expect some market tomfoolery as we remain stuck between two ranges. Lower timeframes are mostly just noise for now. Stay patient.

4H

On the 4H time frame, here’s a visual of what the noise I was speaking of looks like.

The Fundamentals

While Bitcoin’s hash rate (Image 7) has seen a slight dip over the past month, the network remains stronger than ever. If the bull market continues, expect this chart to maintain its parabolic trajectory—especially from a long-term macro point of view.

For a bit of perspective, compare Bitcoin’s hash rate today to when China banned it in 2021. In my humble opinion, the only thing that could genuinely stop this unstoppable force is a fundamental shift in our understanding of physics.

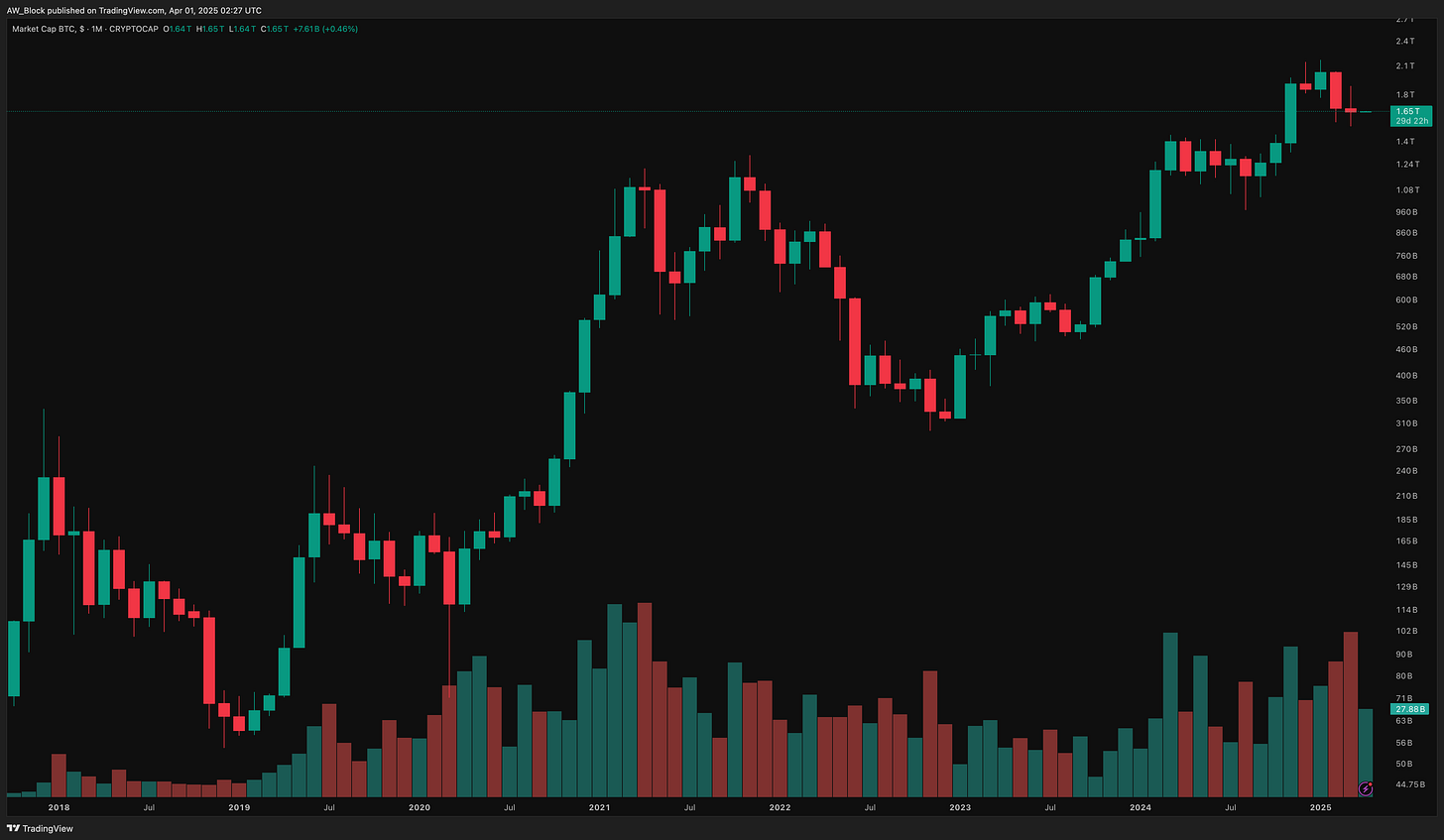

Bitcoin’s market cap at the time of writing this is $1.64 trillion (Image 8).

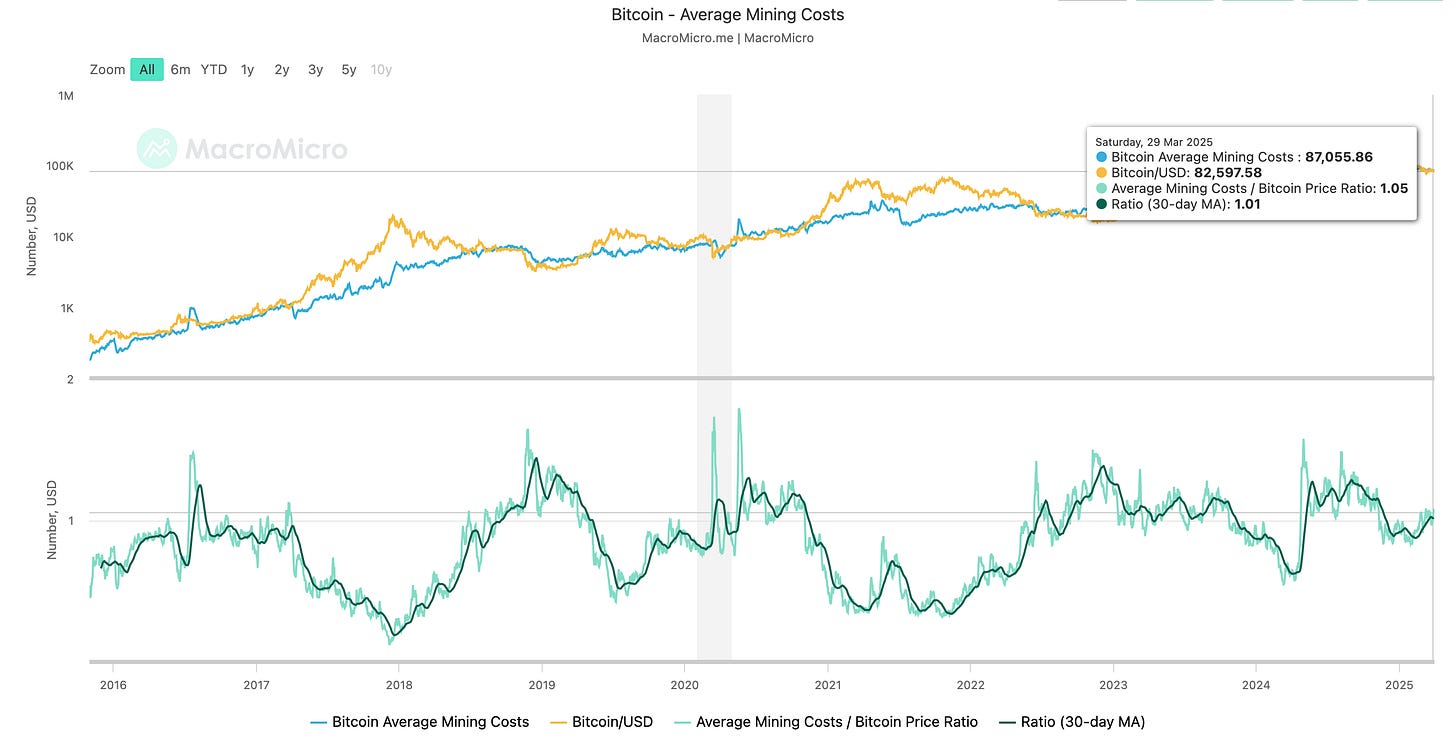

As of March 29, 2025, the cost to mine a single Bitcoin is approximately $87,000 USD (Image 9). If this bull run were already over, it would mark the first cycle where the price did not significantly exceed the average mining cost.

Historically, when a bear market begins, Bitcoin’s price tends to revert to its mean, fluctuating until the cost of proof of work—combined with the halving of block rewards and increasing demand—catches up. This pattern has repeated itself cycle after cycle, and I expect it to continue until proven otherwise.

Bitcoin News

Highlights from the month of March

Texas Strategic Bitcoin Reserve Bill Passes The Senate

The United States Officially Establishes A Strategic Bitcoin Reserve

GameStop Announces $1.3 Billion Fundraising Plan to Purchase Bitcoin

FDIC Says Banks Can Engage In Bitcoin And Crypto Without Prior Approval

How Bitcoin ETFs and Mining Innovations Are Reshaping BTC Price Cycles

If you have any suggestions, feel free to reach out to me on X. I’m always looking to improve and add value in ways others might enjoy—just keep it Bitcoin only.

Stack Sats,

Will